Money goals are an interesting topic. According to this 2019 report by the Financial Consumer Agency of Canada, 69% of Canadians are saving for retirement, 66% set short-term goals, and 64% have an emergency fund set aside for, well, emergencies. Then there’s student loan repayments and mortgages. 50% of Canadians between the ages of 18 and 24 have student loans, with 36% of people 25 to 29 and 21% of those 30 to 34 still paying off their loans. 88% of Canadians between the ages of 25 to 44 have mortgages. (All stats are from a study done in 2019; read the full report here.)

As you can see, not everyone has a savings plan or even a debt to repay. Those who do have probably already set and are working towards their savings goals. However, to those who don’t have any money goals, we have a bold suggestion for you: maybe you should!

3 reasons why you should set money goals

There’s no downside to making a money goal for the year – even if it’s a small one! Here are three ways having a money goal will make your life better.

Having money set aside gives you the freedom to choose.

If someone invites you on a camping trip in the summer, you’ll be able to go. If you see something you really want to buy, you can buy it without worrying about the cost (as much). If you decide you want to try launching a new business, you can do that too!

You’ll feel financially secure & less stressed during emergencies.

Even just a small amount set aside can keep you from panicking when something unexpected happens, bad or good. If you have a sudden home repair or car repair, you can get it done without thinking about having to pay back your credit card or a loan.

A money goal keeps you motivated.

Some people save when they can with no real goal in mind. This opens the door for their savings money to go towards other, seemingly more urgent things. When you set a money goal, you have a solid, valid reason to put that money aside instead of spending it right away. Plus, you’ll get that sense of accomplishment we all love when you achieve your goal.

Just a few money goals ideas

Nearly every article we read about savings and money goals includes the following “must have” goals.

- Emergency fund (to cover 2-3 months of expenses, in case of job loss)

- Retirement

- Planned vacation

- Home / car repairs

- Big purchases (furniture, for example)

- Paying off debt (student debt, lines of credit, mortgages)

- Education (RESP for your children; or a savings plan so you can go back to school if you so choose)

If you’ve already planned for the above and are looking for alternative ideas, here are a few we think are worth the effort.

- Holiday season / gifts: saving through the year makes the holidays much less stressful.

- Treat yourself: If you’ve ever watched Parks and Recreation, you’ll know what we’re talking about. Essentially, it’s a savings fund so once a year you can really pamper yourself!

- Just because: similar to Treat yourself, only instead of it being a one-day splurge, you use this when you find something want “just because”. Keep adding to it throughout the year. If you don’t use it, you’ll have even more for next year!

7 ways to achieve your financial goals

For any and all money goals, setting an “amount goal” or giving yourself a plan to follow will increase your chances of success. These seven plans are just a few of the ways we’ve saved money in the past. Try one of these, or modify them to work for your unique situation.

Set amount with a hard deadline

If you have a payment you need to make or something you’re planning on buying, you probably already know how much money you need. You’ll also have an idea, even a rough one, of when you’ll need it. If that’s the case, to make your saving plan, divide the amount by the number of months you have left. The result will be the monthly amount you’ll need to set aside to achieve your goal.

Weekly savings

This is where you put a set dollar amount aside each and every week. For example, “I’ll put $10 a week in my ‘maybe someday’ fund”. At the end of the year, you’ll have $520. You decide not to use your ‘maybe someday’ fund during the first or second year, so at the end of two years, you’ll have $1040. In the third year, you decide to merge it with your vacation fund and go on a trip somewhere warm!

Amount equal to week number

A variation on the weekly savings above, this one involves putting the amount of money aside equal to the week number. For example, the first week of the year, you put $1 aside. 2nd week, it’s $2. 3rd week it’s $3. 10th week it’s $10. 23rd week, it’s $23. And so on and so forth until the last week of the year ($52). The total potential savings with this is $1326 (if we’ve done our math right).

Dollar a day

This is where you put a dollar aside each day for the entire year. You can change this to any amount you want – $1, $2, $10, etc. At the end of the first year, you’ll have $365; at the end of the second, $730; at the end of the third, $1095. This one takes a bit longer to add up, but if you do it consistently for, say, 10 years, you’ll have $3650. If you put it in a high interest savings account, or invest it at the end of each year, you can increase your returns.

Set amount per pay cheque

Set aside an amount of your choice every time you get your pay cheque (or have an invoice paid, in the case of freelancers). We like nice round numbers, so one thing we’ve done is to go in, round our bank account balance down to the nearest hundred (or $50) increment. Then move the excess into a savings account. Let’s say a client pays an invoice totalling $743.24. You already had $136.35 in your bank account. Your total balance is $879.59. You move $79.59 into your savings, leaving $800 in your spending account.

Round up your debit purchases

Some banks offer the option to round up all your debit card purchases to the next dollar, and put that extra money into a high interest savings account for you. If you go this route, check in once a month to see how well you’re doing and if you’re closing in on your goal.

Change jars

Back when we were all using cash money a whole lot more, having loose change was very common (at least in our household). If you find that’s the case, it’s worth it to drop all that loose change into a change jar – set the jar by your front door and make it a habit to unload your change when you get home. Once a month or every few months or even once a year, go through the jar, roll up your change and deposit it into a savings account.

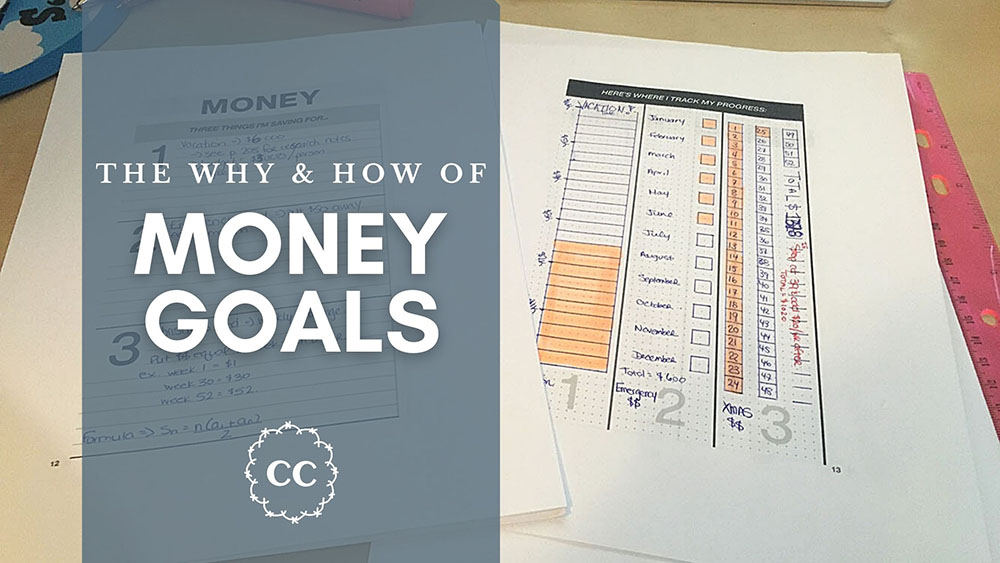

Looking for an easy way to set and track your money goals? Grab your Clever Cactus planner and flip to page 12 – there’s space to plan and track your progress on three different goals!